SPREAD BETTING

The financial world is one of mystery to most of the uninitiated. Those charts, figures, terms, methods, tactics seem like a foreign language that most of us can never learn. We see millionaires and billionaires getting richer through the stock, derivative, binary option, forex or spread betting markets. Some methods require some major starting capital while others will let you dip your feet in for pennies on the dollar. Each one of these markets has its own unique benefits and drawbacks. This article will dive into the basics of the world of spread betting

Covering the Spread

Spread betting to most sounds more like the legal and illegal betting that is most predominant in the world of sports. This is due to the roots of financial spread betting traces back to the founder of spread betting Charles K. McNeil, a math teacher turned securities analyst turned bookmaker. Mr. McNeil created spread betting for sports betting and it was only started to be used for gold and other financial instruments in 1974. Stuart Wheeler founded the IG Index which listed the first spread betting investment options.

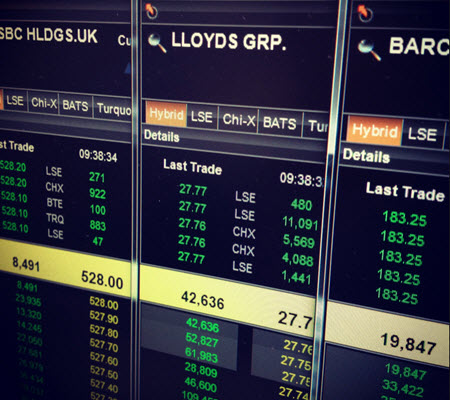

So, what exactly is financial spread betting? By definition spread betting refers to the derivative strategy investment based on speculation of the direction of a market. In a spread bet you do not take ownership of any of the instruments, security or assets you are investing in. You place your investment or bet on the movement you expect the security to have, based on the two prices offered by the spread betting company. These two prices are commonly known as the bid and ask prices.

The difference between the two prices (bid and ask) are what we refer to as the spread. In sports betting you place your bet on whether a game will be won by less than x points and more than y points. Similarly, in financial spread betting you bet on whether the offered security will be lower than the bid price and higher than the ask price.

Benefits and Payout

If you decide to place a spread bet then you will need to know the spread bet stake. The spread bet stake determines your winnings and losses in a spread bet. A spread bet stake is the predetermined amount of money paid for each point of movement of the underlying security. Simply put your winnings are determined by multiplying every point of movement by the spread bet stake. If the stake is $50, and there is 11-point movement on the security would be rewarded by a $550 payout.

Of course, this payout only happens when the security you bet on moves in the right direction. As expected if the movement goes in the opposite direction of your bet then you lose the same amount. Your winnings are also calculated per each share of the bet which you bought. So, if you bought ten shares, you could walk out with a crisp payout or crippling loss of $5,500. This makes spread betting as enticing, exciting and terrifying as spread betting in sports.

The ability to bet on commodities, currency pairings, stocks, indices, and fixed security incomes opens up a vast number of markets to spread betting investors. This access to such a vast selection of markets makes spread betting unique and inviting.

Another great advantage of spread betting is the tax-free and commission-free structure. The commissions are added into the spreads companies offer, but you do not get charged any extra commissions while betting. spread bets are leveraged products, requiring you to have a small percentage of the actual amount needed to place a bet. This can multiply your winnings and losses immensely so make sure you do not risk more than you have.